M&A Advisory

戦略立案から、オリジネーション、実行まで、M&Aの全プロセスで的確なアドバイスを提供

Growin’ Partners provides comprehensive advice for all M&A processes, from strategy planning and origination to execution.

M&A戦略立案支援 M&A strategy planning

戦略的ディール オリジネーション Strategic deal origination

豊富なM&A案件の支援実績によって培われた、候補会社のリサーチ能力と、様々な業種の企業や専門家とのネットワーク、日々寄せられる買収・売却のニーズ情報により、クライアントにとってシナジー効果の最大化が期待できるM&A対象会社の選定とアプローチを支援します。

Through extensive research of target companies, partner networks, and daily reports, we assist in identifying and approaching M&A targets to maximize synergies.

取引条件検討・交渉を支援し、意思決定をサポート Transaction term review, negotiation, and decision making

M&A実行プロセス全体のプロジェクトマネジメントと必要な検討の支援やアレンジメントを行います。

We rigorously monitor project management and make necessary arrangements throughout the M&A execution process.

M&Aの目的やニーズに合った取引条件を検討した上で、条件実現のための効果的な交渉を支援し、基本合意書や最終契約書などの作成についてもフィナンシャル・アドバイザーの立場で助言を提供します。

Our priorities are effective negotiations to fulfil conditions, practical terms which fit our clients’ M&A objectives, and sound financial advice on the preparation of letters of intent (LOI) and final contracts.

また、社内の検討・説明・承認用の資料作成などクライアントの円滑な意思決定のサポートも実施します。

We also support our clients’ decision making by preparing materials for internal discussion, explanation, and approval.

M&Aストラクチャーの設計 Skilled drafting of M&A strategies

豊富な支援事例に基づく知見の蓄積により、会社法・金融商品取引法、会計、税務などを総合的に検討し、クライアントのニーズを満たす、売り手・買い手双方のステークホルダーにとって最適なM&Aストラクチャーを設計します。

Thanks to our extensive history with successful transactions, we are able to comprehensively consider all aspects of our clients’ strategies, including corporate law, financial instruments and transaction law, accounting, and taxation. With all of these tools at our expert disposal, we design M&A structures that are optimal for all stakeholders—sellers and buyers alike.

資本政策・資金調達支援 Capital policy and financing support

M&A実行のために必要な資金の調達について、エクイティ、シニアローン、メザニンなど、クライアントのニーズに合わせた多様なファイナンス手法を提案します。

M&A execution requires funds. To raise those funds, we propose a variety of financing options tailored to each client’s need, such as equity, senior loans, and mezzanine financing.

また、M&A実行時のみならず、資本コストの適正化のための資本・負債の組み換えや第三者割当増資などによる最適な資本構成の実現をサポートいたします。

Our support doesn’t end there. We also aid in the realization of optimal capital structure beyond the M&A itself, finding the ideal combination of capital and debt to optimize costs and third-party allotment.

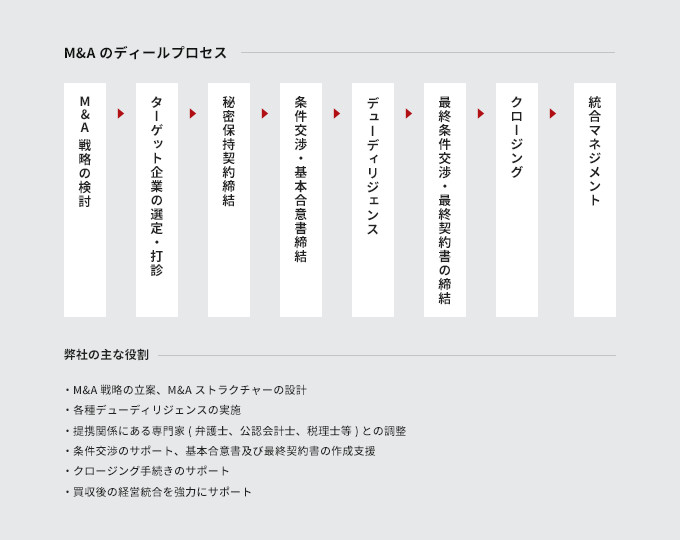

ー Our M&A deal process ー

1. Examination of M&A strategy

2. Selection and approach of target companies

3. Confidentiality agreement (CA/NDA)

4. Negotiation of terms and signing of letter of intent (LOI /MOU)

5. Due diligence

6. Negotiation of final term, signing of M&A agreement

7. Closing support

8. Post-merger integration (PMI)

ー Our main roles ー

- Formulation of M&A strategy, design of M&A structure

- Due diligence support

- Coordination with experts (lawyers, CPAs, tax accountants, etc.)

- Assistance negotiating terms, drafting basic agreements, and settling final agreements

- Closing procedure support

- Strong PMI support

SERVICES

M&A Advisory

戦略立案から、オリジネーション、実行まで、M&Aの全プロセスで的確なアドバイスを提供

Valuation & Modeling

信頼性の高い独立算定機関として、価値評価の公正性を担保

Due Diligence

財務会計・税務・ビジネス上の課題を抽出し、M&Aの成功に向けた意思決定をサポート

Purchase Price Allocation – PPA (取得価格配分)

取得価額の資産・負債への配分において、無形資産の識別・評価をサポート

Post Merger Integration – PMI

買収シナジーを最大化するための円滑な経営統合をサポート

Business Succession (事業承継)

大切に営んできた事業の価値を維持・向上するための事業承継をサポート

Cross-border M&A

グローバル化する経営に必須となるクロスボーダーM&Aの実行を、ワンストップでサポート

クライアントの企業価値最大化に向けた経営戦略・事業戦略を明確にし、事業成長と事業領域拡大や戦略的な事業売却を含めた事業ポートフォリオの再構築を実現するために必要となるM&A戦略を策定します。

We clarify business and operation strategies to maximize corporate value and implement M&A. Beginning with growth and moving through to expansion, we also assist with divestment.