Purchase Price Allocation – PPA (取得価格配分)

取得価額の資産・負債への配分において、無形資産の識別・評価をサポート

Growin’ Partners identifies and evaluates intangible assets in the allocation of acquisition value.

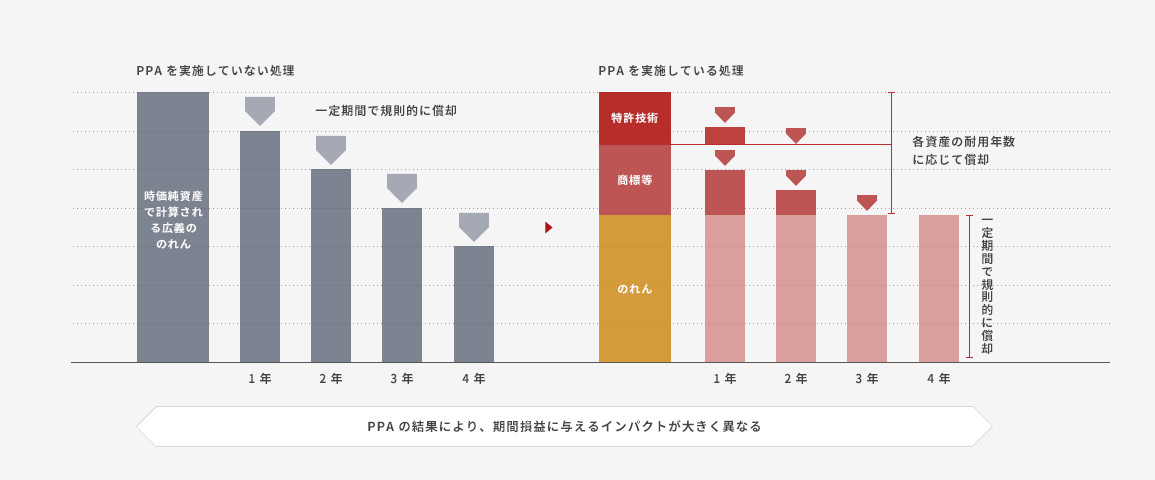

すなわち、企業結合にともなって取得・移転される個々の資産や負債を時価評価し、商標権・顧客資産等の無形資産、のれん、負ののれんを識別することで、企業結合の会計取引を財務諸表に適切に反映させることを目的としています。

In other words, accounting for acquired businesses. This is done by marking each acquired/transferred asset or liability with its market value. It also involves identifying intangible assets, such as trademark rights and customer assets, goodwill, and negative goodwill. The purpose of PPA is to reflect values accurately.

M&A実行フェーズにおけるPPAシミュレーション(Pre-Closing PPA) PPA simulation during M&A execution (pre-closing PPA)

M&A検討段階にPPAを実施することで、計上される可能性がある無形資産の種類と配分額、のれん金額、及び配分された各無形資産の償却負担の影響を推定することにより、M&A 実行後の損益計算書に与える損益インパクト等を分析した上で、買収価額の検討を行うことが可能となります。

To implement PPA at the M&A review stage, we first analyze the impact of certain values (profit and loss, etc.). After that, the acquisition price can be analyzed by estimating the effect of each intangible asset recorded, the amount of goodwill, and the amortization burden.

M&Aを進めていく中で、買収後の会計数値をシミュレーションすることはM&A実行の判断及び買収価額の決定においても極めて重要な情報となります。

Simulating post-acquisition accounting figures during M&A provides critical information for execution strategy, acquisition prices, and other decisions.

グローウィン・パートナーズでは、豊富な経験に基づき、M&A案件の検討段階から実行後の会計数値をシミュレーションし、M&Aに関する意思決定を適切にサポートいたします。

At Growin’ Partners, our wealth of experience enables us to simulate accounting figures. We do this after an M&A project’s review phase in order to guide the client through various key decisions.

M&A実行後のPPAによる会計処理サポート PPA accounting support post-M&A

PPAは、買収企業側の財務諸表に重要な影響を与えるため、会計監査を実施する監査法人の関心も高くなっています。

PPA has a considerable impact on the financial statements of acquired companies, and audit firms are justifiably interested in the results.

実務上は特に、配分される無形資産の種類の識別と評価が重要であり、評価技術のみならず、監査法人との事前協議や監査プロセスでの対応などがPPAを円滑に実施するためのポイントになります。

In practice, it is particularly important to identify and evaluate the types of intangible assets to be allocated. To ensure smooth implementation of PPA, we rely not only on evaluation technology, but also on prior consultation with auditors.

グローウィン・パートナーズは、大手監査法人出身者による豊富な経験に基づき無形資産の価値評価ときめ細かい監査対応を行い、M&A実行後のPPAによる会計処理をサポートいたします。

Growin’ Partners has long supported PPA accounting after M&A execution. As such, we are well versed in the audit process. We have the know-how to assess the value of intangible assets and respond promptly to auditor inquiries.

SERVICES

M&A Advisory

戦略立案から、オリジネーション、実行まで、M&Aの全プロセスで的確なアドバイスを提供

Valuation & Modeling

信頼性の高い独立算定機関として、価値評価の公正性を担保

Due Diligence

財務会計・税務・ビジネス上の課題を抽出し、M&Aの成功に向けた意思決定をサポート

Purchase Price Allocation – PPA (取得価格配分)

取得価額の資産・負債への配分において、無形資産の識別・評価をサポート

Post Merger Integration – PMI

買収シナジーを最大化するための円滑な経営統合をサポート

Business Succession (事業承継)

大切に営んできた事業の価値を維持・向上するための事業承継をサポート

Cross-border M&A

グローバル化する経営に必須となるクロスボーダーM&Aの実行を、ワンストップでサポート

PPA(Purchase Price Allocation)とは、企業買収成立後に買収価額を、被買収側企業の資産及び負債の時価を基礎として、適切な勘定科目に配分することを意味します。

Purchase price allocation (PPA) refers to how acquisition prices are allocated to the appropriate account item based on market value of assets or liabilities.